Whatever You Required to Find Out About Offshore Investment for Global Wealth Growth

Whatever You Required to Find Out About Offshore Investment for Global Wealth Growth

Blog Article

All About Offshore Investment: Insights Into Its Advantages and Factors To Consider

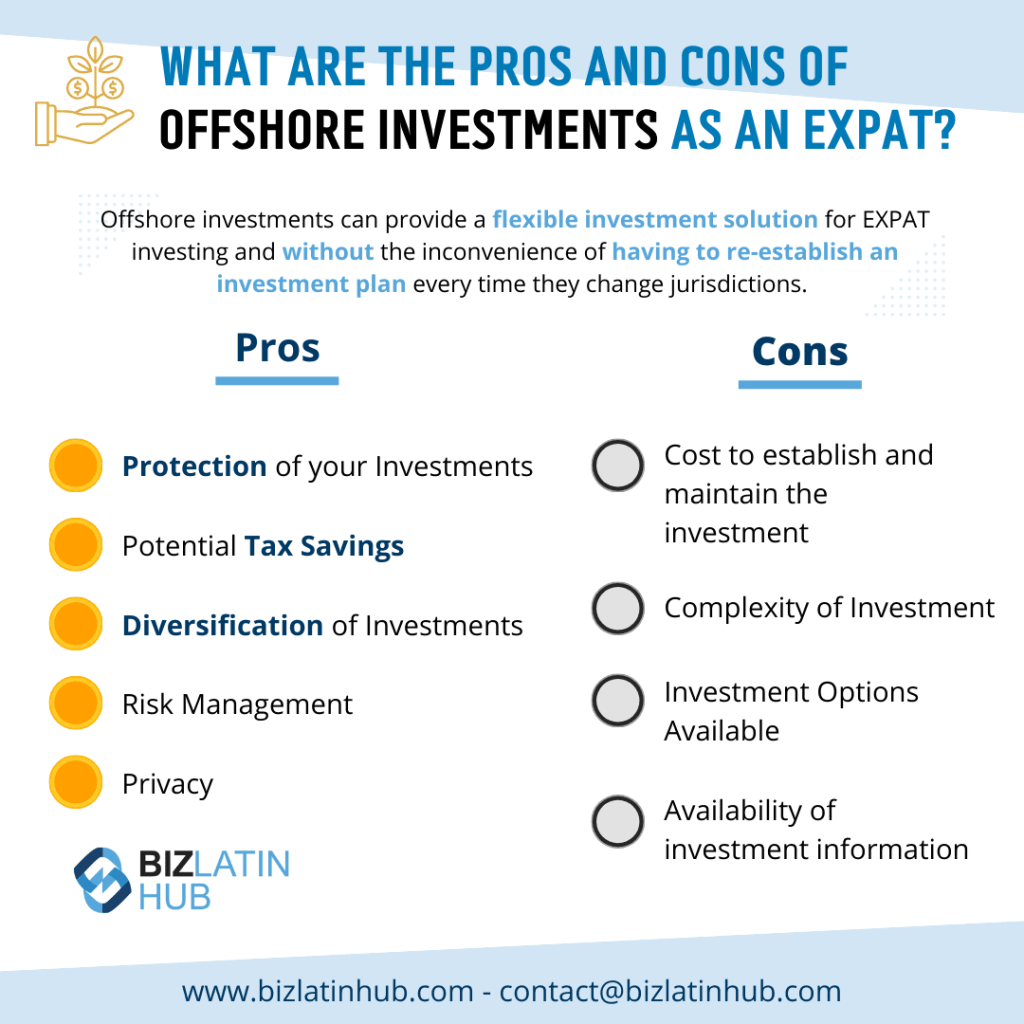

Offshore financial investment has come to be a significantly pertinent subject for individuals looking for to expand their portfolios and improve financial security. As we check out the nuances of offshore investment, it becomes noticeable that educated decision-making is vital for maximizing its potential advantages while alleviating integral dangers.

Recognizing Offshore Investment

In the world of global finance, understanding offshore investment is critical for individuals and entities looking for to maximize their economic portfolios. Offshore financial investment refers to the positioning of possessions in banks outside one's country of residence. This practice is usually made use of to achieve various financial goals, including diversity, possession security, and possible tax obligation advantages.

Offshore financial investments can encompass a large variety of financial instruments, including supplies, bonds, shared funds, and genuine estate. Investors may choose to establish accounts in jurisdictions recognized for their positive regulative environments, personal privacy regulations, and economic security.

It is important to recognize that offshore investment is not naturally identified with tax evasion or immoral tasks; instead, it serves genuine objectives for lots of investors. The inspirations for involving in offshore financial investment can differ extensively-- from seeking greater returns in established markets to securing assets from financial or political instability in one's home country.

However, prospective capitalists should additionally recognize the intricacies involved, such as compliance with worldwide regulations, the necessity of due diligence, and comprehending the legal implications of offshore accounts. Generally, an extensive understanding of overseas financial investment is vital for making educated economic decisions.

Trick Advantages of Offshore Investment

Offshore financial investment supplies numerous vital benefits that can improve an investor's monetary method. One noteworthy benefit is the possibility for tax optimization. Numerous overseas jurisdictions offer beneficial tax obligation routines, enabling investors to reduce their tax obligation liabilities legitimately. This can dramatically enhance overall returns on investments.

In addition, offshore investments typically provide access to a more comprehensive variety of investment chances. Financiers can diversify their profiles with properties that might not be readily offered in their home countries, including global stocks, realty, and specialized funds. This diversity can decrease threat and enhance returns.

Additionally, offshore financial investments can promote estate preparation. They make it possible for investors to structure their possessions in such a way that decreases estate taxes and ensures a smoother transfer of wealth to beneficiaries.

Typical Dangers and Difficulties

Buying overseas markets can present different dangers and obstacles that need cautious consideration. One substantial danger is market volatility, as offshore investments may go through fluctuations that can affect returns drastically. Capitalists should additionally recognize geopolitical instability, which can disrupt markets and influence investment efficiency.

Another difficulty is currency danger. Offshore financial investments frequently entail purchases in international currencies, and negative currency exchange rate motions can erode revenues or rise losses. Offshore Investment. Furthermore, limited access image source to dependable details about overseas markets can hinder enlightened decision-making, leading to prospective bad moves

Absence of regulative oversight in some overseas jurisdictions can also present hazards. Investors may discover themselves in settings where investor defense is marginal, raising the threat of scams or mismanagement. Differing monetary practices and social attitudes towards investment can make complex the financial investment procedure.

Legal and Regulative Factors to consider

While browsing the complexities of offshore financial investments, comprehending the regulative and lawful landscape is vital for making certain and securing assets compliance. Offshore investments are typically subject to a multitude of laws and regulations, both in the capitalist's home nation and the territory where the investment is made. As a result, it is vital to conduct extensive due persistance to comprehend the tax implications, reporting requirements, and any kind of lawful responsibilities that might arise.

Regulative frameworks can differ significantly between territories, affecting everything from taxes to resources needs for foreign financiers. Some nations may use desirable tax obligation routines, while others enforce strict laws that could deter financial investment. Additionally, worldwide agreements, such as FATCA (International Account Tax Obligation Compliance Act), may obligate financiers to report offshore holdings, enhancing the demand for openness.

Capitalists should additionally recognize anti-money laundering (AML) and know-your-customer (KYC) laws, which need banks to verify the identity of their customers. Non-compliance can cause serious fines, consisting of fines and constraints on investment tasks. As a result, involving with lawful specialists concentrating on worldwide investment legislation is essential to navigate this detailed landscape successfully.

Making Educated Choices

A strategic method is crucial for making notified choices in the realm of overseas financial investments. Recognizing the intricacies included requires thorough research study and analysis of different aspects, including market fads, tax obligation ramifications, and lawful structures. Investors should evaluate their threat Offshore Investment resistance and financial investment objectives, guaranteeing positioning with the special features of offshore possibilities.

Inspecting the regulatory atmosphere in the picked territory is crucial, as it can substantially affect the safety and success of investments. Additionally, staying abreast of geopolitical developments and financial conditions can supply valuable insights that notify financial investment strategies.

Engaging with specialists who focus on overseas investments can additionally improve decision-making. Offshore Investment. Their competence can guide capitalists via the intricacies of global markets, helping to identify prospective pitfalls and financially rewarding this page opportunities

Ultimately, informed decision-making in overseas financial investments rests on a versatile understanding of the landscape, a clear articulation of specific objectives, and a dedication to continuous education and learning and adaptation in a dynamic global setting.

Verdict

In final thought, offshore financial investment provides considerable advantages such as tax obligation optimization, property protection, and access to international markets. By resolving these factors to consider, financiers can successfully harness the benefits of offshore investments while mitigating potential downsides, inevitably leading to educated and tactical financial decisions.

Offshore investment offers a number of essential advantages that can enhance a capitalist's financial strategy.Additionally, overseas financial investments often offer accessibility to a more comprehensive range of investment chances. Varying financial methods and social mindsets toward investment can make complex the investment procedure.

Report this page